An extensive guidebook Checking out insolvency in detail — its definition, causes, forms, impact on men and women and companies, and the different Restoration strategies to handle economic distress successfully.

Understanding Insolvency: A Comprehensive Definition

Insolvency is a vital money condition exactly where a person, organization, or Group is not able to shell out its debts because they grow to be because of. It is vital to realize that insolvency is different from simply being low on hard cash or owning lousy liquidity — it refers specially to the inability to fulfill economic obligations on time or when demanded by creditors.

There are 2 Main means insolvency can existing itself: as a result of

Knowledge insolvency is important for business people, traders, creditors, and persons alike, mainly because it marks a pivotal financial point out That always leads to lawful proceedings such as individual bankruptcy, administration, or liquidation.

Results in of Insolvency: What Drives Financial Distress?

Insolvency rarely happens overnight. It is normally the result of a series of economic missteps, external pressures, or unexpected gatherings. Determining the root will cause is key to addressing and potentially protecting against insolvency.

1. Weak Funds Movement Administration

Just about the most common good reasons for insolvency is The shortcoming to deal with income move efficiently. Enterprises or folks may have lucrative operations on paper, but if they cannot acquire payments or hold off spending creditors, insolvency becomes imminent. Late payments from prospects, poor invoicing methods, and extreme expenditures can all contribute to this problem.

two. Too much Personal debt and Over-Leverage

Borrowing money is a standard way to fund growth, but when personal debt amounts develop into unsustainable, insolvency challenges rise sharply. Substantial-curiosity payments, ballooning principal quantities, and aggressive lending phrases can overwhelm the debtor’s ability to sustain.

3. Economic Downturns and Marketplace Modifications

Broader financial aspects like recessions, inflation spikes, or sector-distinct downturns can influence money and profits dramatically. Businesses reliant on cyclical markets may perhaps locate revenues shrinking unexpectedly, bringing about insolvency.

four. Operational Inefficiencies and Bad Management

Inefficient operations, abnormal overhead costs, or inadequate strategic decisions—including coming into unprofitable marketplaces or failing to innovate—can cause economic strain and press an entity toward insolvency.

5. Surprising Functions and Authorized Difficulties

Purely natural disasters, lawsuits, fines, or regulatory penalties can impose unexpected economical burdens that idea a company or unique into insolvency.

six. Alterations in Shopper Choices or Competitiveness

Failure to adapt to transforming current market needs or improved Opposition can decrease revenues and profitability, exacerbating financial challenges.

Kinds of Insolvency: Cash Stream vs Balance Sheet

Insolvency will not be a a single-sizing-fits-all thought. There are two principal classes:

Hard cash Movement Insolvency

This manner of insolvency occurs when a business or particular person can't pay debts as they come because of, regardless of whether they have assets exceeding liabilities. It’s a liquidity difficulty the place hard cash is not accessible when essential. One example is, a corporation could possibly own valuable products or house but have no Completely ready dollars to deal with payroll or supplier invoices.

Cash move insolvency may very well be momentary and fixable by way of far better administration or limited-term financing.

Equilibrium Sheet Insolvency

Stability sheet insolvency occurs when overall liabilities exceed complete property, meaning the entity’s Internet worth is detrimental. Even though hard cash movement is favourable in the meanwhile, the general financial overall health is weak because liabilities outweigh sources.

This kind often signals a lot more really serious economical difficulty and may need restructuring, asset product sales, or liquidation.

Legal Implications and Insolvency Proceedings

When insolvency is determined, lawful frameworks normally appear into result to guard creditors and supply a good resolution mechanism. Insolvency legal guidelines differ by jurisdiction but usually include quite a few vital aspects:

1. Formal Insolvency Procedures

Depending on the problem, a court or regulatory system may possibly appoint insolvency practitioners to manage the method. Popular official insolvency procedures consist of:

Administration: An appointed administrator usually takes Charge of the organization to try to restructure and rescue it. Liquidation: Assets are offered off to repay creditors, normally ending with company dissolution. Firm Voluntary Arrangements (CVAs): Negotiated agreements concerning a business and its creditors to pay debts with time even though continuing operations. Bankruptcy: Legal process primarily for people, letting discharge of debts underneath court supervision.

two. Creditors’ Rights and Protections

Insolvency regulations purpose to stability interests by guaranteeing creditors are addressed reasonably, usually via a structured claims process and prioritization of credit card debt repayments.

three. Repercussions for Administrators and Management

Directors of insolvent companies may facial area legal scrutiny if mismanagement or wrongful buying and selling is suspected. Insolvency practitioners also look into prior conduct to protect stakeholder interests.

Effect of Insolvency on Enterprises

Insolvency profoundly affects firms further than just funds. The important thing impacts incorporate:

Lack of Management: Regulate shifts from entrepreneurs or administrators to administrators or liquidators.Name Problems: Insolvency announcements often shake shopper and supplier self-assurance, decreasing company alternatives.Operational Disruptions: Delays in payments, staff layoffs, or provide chain interruptions often come about. Shareholder Losses: Fairness holders are frequently past in line and may get rid of their entire investments. Opportunity for Restoration: In some instances, insolvency proceedings can restructure credit card debt and empower a company to emerge leaner plus much more competitive.

Impression of Insolvency on People today

For people, insolvency frequently results in bankruptcy or personal debt aid plans with various outcomes:

Credit score Limits: Bankruptcy documents can remain on credit history information for years, limiting borrowing ability. Asset Decline: Personal property might be seized or offered to repay creditors. Legal Limitations: Bankrupt people may possibly face limitations on fiscal things to do. Clean Money Get started: Bankruptcy can discharge particular debts, enabling a completely new get started.

Procedures for Taking care of and Recovering from Insolvency

When insolvency is hard, proactive management can enhance results:

Early Recognition and Action

Recognizing monetary distress early and looking for advice immediately can open up up a lot more alternatives, such as renegotiating debts or securing small-expression funding.

Engaging Creditors and Negotiating Terms

Transparent conversation with creditors can lead to restructured payment options, decreased fascination, or non permanent aid.

Operational Expense Regulate and Money Circulation Management

Reducing unwanted expenses, optimizing stock, and accelerating receivables help boost liquidity.

Trying to find Expert Insolvency Suggestions

Licensed insolvency practitioners offer vital assistance on legal options, regardless of whether restructuring, voluntary arrangements, or personal bankruptcy filings.

Thinking of Formal Restructuring or Liquidation

Depending on severity, formal insolvency procedures can preserve price, safeguard property, and provide orderly credit card debt resolution.

Avoiding Insolvency: Best Techniques for Monetary Health and fitness

In order to avoid insolvency, individuals and firms should adopt sound economical behavior which include:

- Sustain Correct Fiscal Data: Well timed and exact accounting will help establish issues early.

- Money Flow Forecasting: Frequently venture potential inflows and outflows to foresee shortages.

Prudent Financial debt Administration: Avoid around-borrowing and assure sustainable repayment programs.Establish Reserves: Preserve unexpected emergency resources to protect sudden charges. Ongoing Enterprise Evaluate: Adapt tactics to marketplace problems and shopper requirements.

The Purpose of Insolvency Practitioners

Insolvency practitioners are experts licensed to deal with insolvency procedures professionally and ethically. Their duties incorporate:

- Assessing economic scenarios to advise on choices.

- Managing administration, liquidation, or individual bankruptcy processes.

- Guarding pursuits of creditors and debtors.

- Negotiating arrangements To optimize financial debt Restoration.

They act as neutral intermediaries and are frequently pivotal to reaching the very best end result in insolvency situations.

Prevalent Myths and Misconceptions about Insolvency

Lots of people misunderstand insolvency, resulting in avoidable concern or inaction. Below are a few clarifications:

Myth: Insolvency means quick personal bankruptcy. Insolvency may result in individual bankruptcy, but there are lots of other options like restructuring or voluntary preparations.

Reality: Fantasy: Insolvency is usually the fault of negative management.

Fact: Exterior aspects and financial shifts frequently add noticeably.Myth: The moment insolvent, almost nothing can be done.

Simple fact: Early intervention normally saves corporations or people from comprehensive bankruptcy.

website

Summary: Taking Management in Times of Financial Distress

Insolvency, even though overwhelming, is not necessarily the end in the road. With a clear comprehension of its results in and consequences, and by adopting well timed, educated procedures, people today and businesses can navigate monetary distress efficiently.

Proactive administration, open communication with creditors, professional advice, and sometimes official insolvency processes are important to reducing losses and charting a path to recovery or a fresh new fiscal commence.

If you're worried about insolvency, don’t hold off searching for qualified support. Early motion can make all the real difference.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Andrea Barber Then & Now!

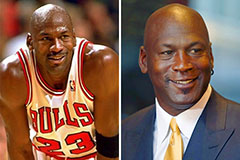

Andrea Barber Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!